tax deferred exchange definition

Tax Deferred Exchange shall have the. If you would like to find out about the reverse exchange process or the tax deferred exchange process contact one of our experts today.

What Is A 1031 Exchange Properties Paradise Blog

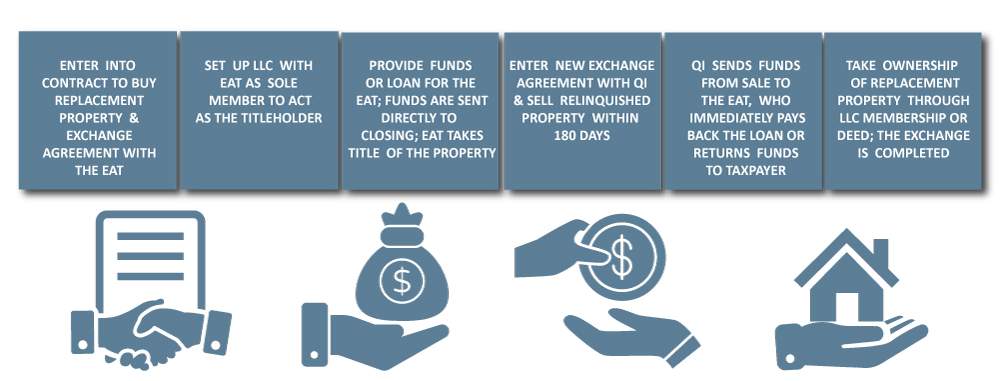

The Reverse Exchange is structured primarily with Revenue Procedure 2000-37 in mind.

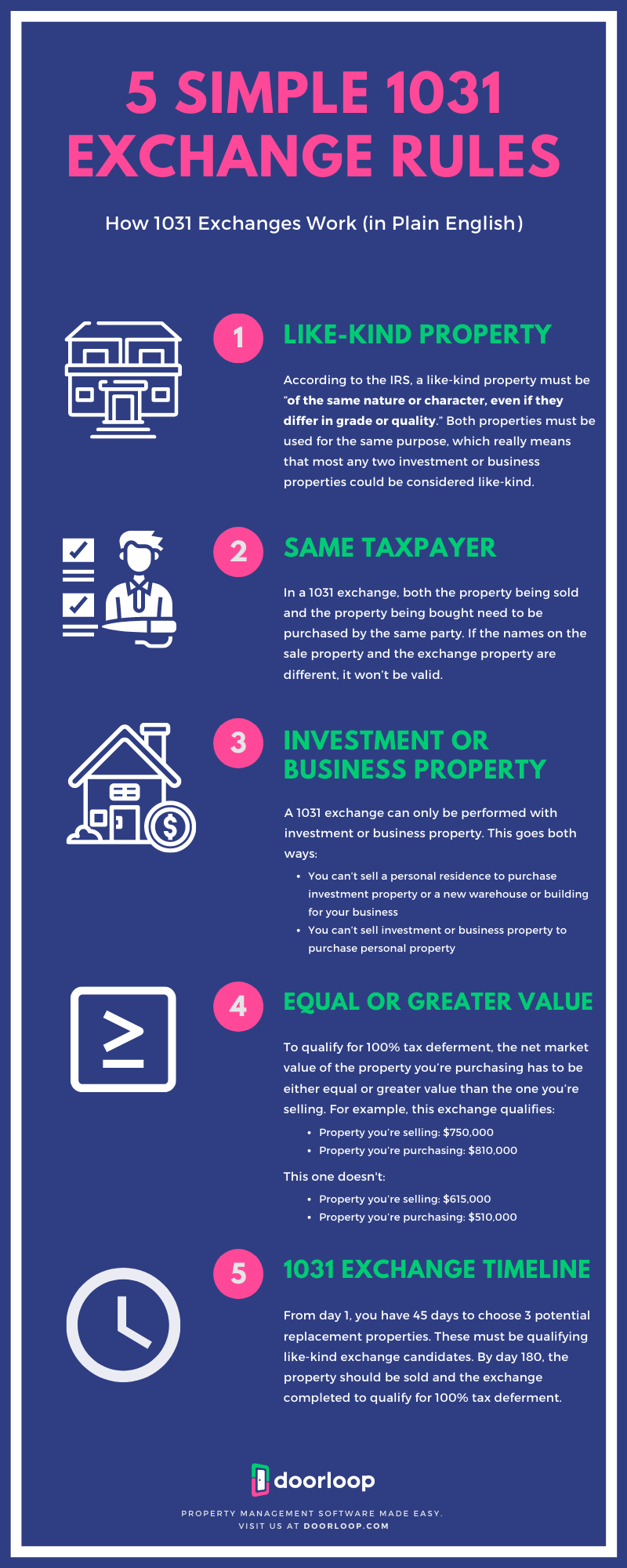

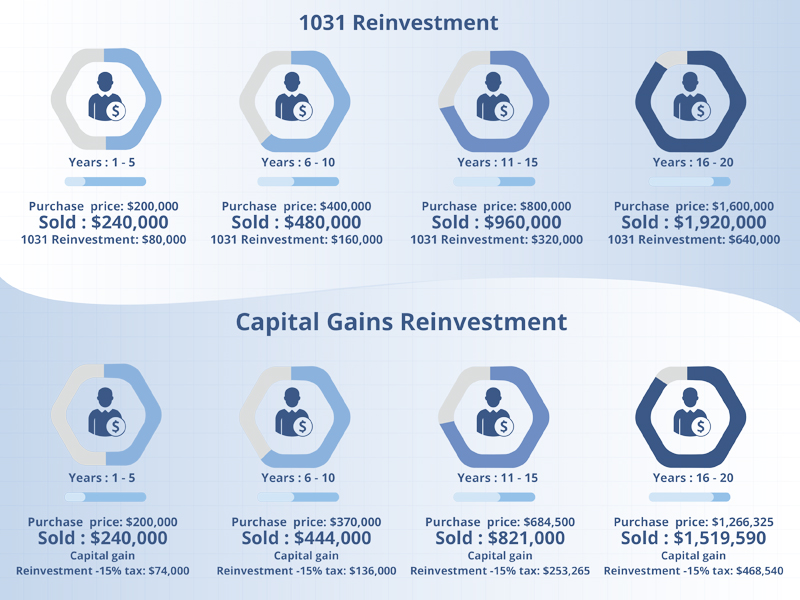

. Specifically the tax code referring to 1031 Exchanges in IRC Section 11031 reads No gain or loss shall be recognized on the exchange of real property. Over the long term consistent and proper use of this strategy can pay. The 1031 tax-deferred exchange is a method of temporarily avoiding capital gains taxes on the sale of an investment or business property.

This property exchange takes its name from Section 1031 of the Internal Revenue Code. Tax Compliance Agreement means the Federal Tax Certificate Tax Compliance Agreement Arbitrage Agreement or other written certification or agreement of the Issuer setting out representations and covenants for satisfying the post-issuance tax compliance requirements for the Tax-Exempt Bonds. This means for the purposes of condemned property the replacement property will be deemed to be like-kind and the requirements met so long as both the condemned and the replacement.

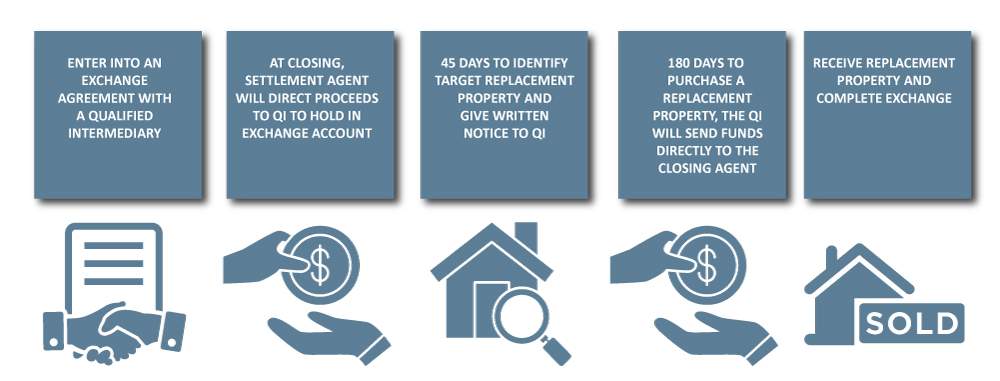

You can sell a property held for business or investment purposes and swap it for a new one that you purchase for the same purpose allowing you to. In a tax-deferred exchange under Internal Revenue Code Section 1031 the sellertaxpayer is prohibited from receiving the proceeds from the sale of the relinquished property. Ad With Decades Of Experience Let Cornerstone Help With Securitized 1031 Replacement Today.

Tax Deferred Exchange is defined in Section 125. A section of the US. Tax Deferred Exchange shall have the meaning set forth in Section 106.

Gain deferred in a like-kind exchange under IRC Section 1031 is tax-deferred but it is not tax-free. Those taxes could run as high as 15 to 30 when state and federal taxes are combined. Handling earnest money deposits in a 1031 Exchange.

Define Reverse Tax-Deferred Exchange. Enter the 1031 Tax Deferred Exchange. Is determined by expansive definition of like-kind similar to that of Section 1031.

Is a reverse tax-deferred like-kind exchange pursuant to section 1031 of the Internal Revenue Code of 1986 as amended and Revenue Procedure 2000 - Section 1031 promulgated thereunder. Means a series of transactions effected as part of the previous acquisition by the Borrowers of certain of the assets of Saks Incorporated used in the operation of the retail department stores operating under the nameplates McRaes and Proffits pursuant to which the Headquarters Property was exchanged for such assets by. A 1031 exchange is a tax break.

Ultimately the 1031 exchange is a completely legal tax-deferred strategy that any taxpayer in the United States can use. The company also offers strategic advisory asset management tax-deferred exchange and capital markets solutions. By completing an exchange the Taxpayer Exchanger can dispose of investment or business-use assets acquire Replacement Property and defer the tax that would ordinarily be due upon.

The tax deferred exchange as defined in 1031 of the Internal Revenue Code offers taxpayers one of the last great opportunities to build wealth and save taxes. The 1031 Exchange allows you to sell one or more appreciated rental or investment real estate or personal property relinquished property and defer the payment of your capital gain and depreciation recapture taxes by acquiring one or more like-kind properties replacement. The following 1033 tax-deferred exchange frequently asked questions FAQs.

Tax Deferred Exchange has the meaning set forth in Section 108A hereof. Cornerstone Combines The Power Of 1031 Securitized Real Estate. Adjective not taxed until sometime in the future.

1031 Exchanges are complex tax planning and wealth building strategies. IRC Section 1031 provides an exception and allows you to postpone paying tax on the gain if you reinvest the proceeds in similar property as part of a qualifying like-kind exchange. We want to help your 1031 exchange transaction go as smoothly as possible.

A tax deferred exchange that allows for the disposal of an asset and the acquisition of another similar asset without generating a tax liability from the sale of the first. Related to Tax-Deferred Exchange Documentation. Generally have to pay tax on the gain at the time of sale.

Internal Revenue Service Code that allows investors to defer capital gains taxes on any exchange of like-kind properties for business or investment purposes. Define Headquarters Property Tax Deferred Exchange.

Irs 1031 Exchange Rules For 2022 Everything You Need To Know

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

All About 1031 Tax Deferred Exchanges Real Estate Investment Tips Youtube

1031 Exchange When Selling A Business

Delayed Exchange 1031 Tax Deferred Exchange Ipx1031

What Is A Starker Exchange 1031 Exchange Experts Equity Advantage

Everything You Need To Know About 1031 Exchange Rules Kw Utah Kw Utah

1031 Exchange Explained What Is A 1031 Exchange

1031 Exchange What Is It And How Does It Work Plum Lending

1031 Exchange When Selling A Business

Are Tax Deferred Exchanges Of Real Estate Approved By The Irs Accruit

19 Business Requirements Document Examples Pdf Examples Regarding Business Requirements Documen Business Requirements Document Templates Business Template

Are You Eligible For A 1031 Exchange

1031 Tax Deferred Exchange Explained Ligris

1031 Exchange Like Kind Exchange Definition What Is A 1031 Exchange Real Estate Investing Investing Capital Gains Tax

What Is A 1031 Exchange Asset Preservation Inc